Affordability

Diversity

Low Volatility

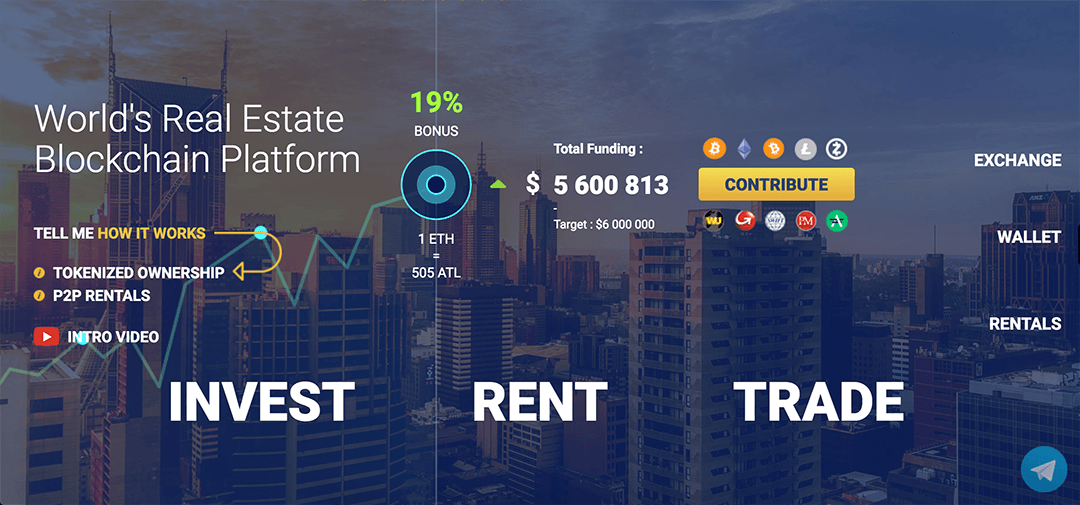

EstatesCo

Re-Inventing Real Estate Investments and Returns

EstatesCo.com is an Internet-age, technology-based holding company which aims to completely re-invent the Real Estate industry, and revolutionise its models of Investment and Return on Investment. We will accomplish this by disrupting conventional business models and legacy structures which no longer give the average income earner adequate access to the property market. We have replaced them with innovative new models which democratize access and enable the Man-in-the-Street to participate in the global Real Estate market.

Estates Co new business models will also deliver a massive stream of fresh new capital into the world’s real estate markets from the millions of new buyers who are currently excluded from buying property with conventional financing. For example, our BuyByRent.com opens up the market to millions of people currently blocked from owning their own home. And, worldwide, it's not just millions of people, but tens of millions or even hundreds of millions who are nowadays spending their money elsewhere and not on the real estate market.

Real Estate – the Ultimate Investment Category

For

as long as people have lived in settled communities, Real Estate has

been the ultimate Investment Category: the safest, most stable Asset

Class and the one, which over time, has generated the best returns. Real

Estate is never going to lose its #1 ranking as the top Asset Class,

but, in recent history, it has become less accessible to most citizens

of the world. Simply put, the price of Real Estate is rising faster than

the incomes of most people. It is becoming more and more difficult to

jump on the property ladder, as market forces are driving the bottom

rungs of the ladder above the reach of all but the very rich.

Innovative, Simplified, Safe

Our

four new property products/investment models, described below, are,

relative to their historical predecessors, Innovative, Simplified, and

Safe. By utilising the latest technology, we are able to facilitate

streamlined transactions at significantly reduced cost; by enabling

peer-to-peer deals and stripping out middlemen and conventional

financing, we further reduce fees; by creating collaborative platforms

we offer fractional ownership to small investors; by individual

vendor-financing, we give new buyers a pathway to home ownership when

all conventional financing avenues are closed to them.

Our Vison is two-fold:

i)

we aim to open up the major segments of the Real Estate market to all

the millions of people who have been locked out of it;

ii) we aim to deliver better, faster, cheaper property investment opportunities for everyone.

Affordability, Diversity, Low Volatility

Our

FinTech innovations and smart platforms provide open access to the

property market, but more than that they must deliver customers with

compelling opportunities to make decent, safe returns from Real Estate

investments. To this end, we have been guided by the need to develop a

range of breakthrough FinTech products that share three vital

characteristics:

Affordability – relative to conventional Real Estate products;

Diversity – in terms of geography, pricing, and size of investment relative to conventional property platforms;

Low Volatility

– providing simple easy ways to access investment opportunities should

not entail higher risks; our business models are carefully designed with

this in mind.

BuyByRent

Ownership by 15 years of Rental Payments.

BuyByRent enables people who are locked out of the property market by being unable to get conventional financing to jump onto the housing ladder and buy their own home. It also streamlines the process and eliminates the cost of the middleman and conventional financing.

Equity Release

Unlocks cash from the value of your home without you needing to move out. A good life now is preferable to an over-generous bequest.

Equity Release Inc. offers a simple, fast and innovative way for you to release cash from the equity in your home without you needing to move out, or to pay anything back in your lifetime. The money you release is yours to do with whatever you like: for example, to improve your lifestyle, or pay off an existing mortgage. Obviously, the amount of money you can cash out depends on your age and the value of your property.

Estates PLC.

The Publicly-Listed Real Estate Stock Exchange.

Enables the average saver and investor to participate in solid real estate investments by allowing them to invest as much or as little as they like.

Estates Pool

The Power of Many plus The Strength of Diversity.

Estates Pool is a collaborative funding platform that enables small investors to come together in a pool to invest in the high-yield, low-risk, mega-projects that as individuals they could not possibly consider. Estates Pool is managed by experts utilising a diversified, multi-asset strategy to mitigate risk and maximise return. And, by virtue of advanced technology and streamlined processes, our management fees are comfortable for the smaller, more prudent investor.